Navigating the 2024 Tax Changes: What You Need to Know

- Michelle Francis

- Dec 24, 2023

- 6 min read

Updated: Feb 16, 2024

Are you ready for the upcoming tax changes in 2024? It's important to stay informed and prepare ahead to navigate the potential impacts on your finances. In this article, we will break down everything you need to know about the 2024 tax changes and how they may affect you.

From changes to tax brackets and increased retirement contributions to new deductions and credits, these changes could have a significant impact on individuals and businesses alike. It's crucial to understand the implications and explore strategies to minimize your tax liabilities and maximize your savings.

We've researched the upcoming tax changes to provide you with accurate and reliable information. We will discuss key updates, potential benefits, and any potential challenges you may face. Whether you are an individual taxpayer or a business owner, this article aims to equip you with the knowledge and tools necessary to navigate the 2024 tax landscape with confidence.

Stay ahead of the curve and prepare for the changes that lie ahead. Read on to ensure you are well-informed and ready to tackle the 2024 tax season head-on.

Understanding the impact on individuals

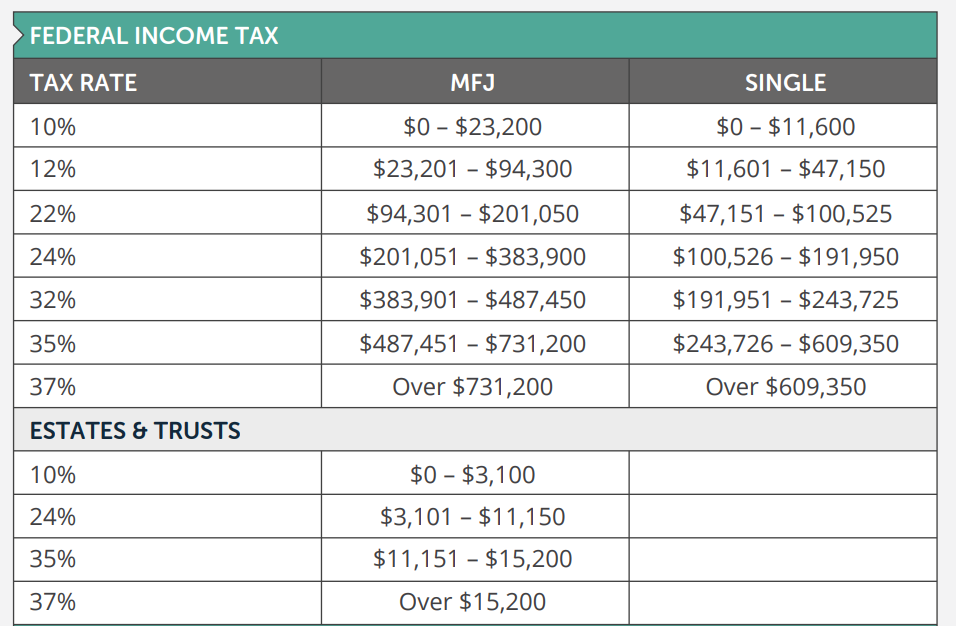

The 2024 tax changes encompass various aspects of the tax code that directly impact individuals and businesses. The income tax brackets have been revised, potentially affecting the amount of tax you owe. It is crucial to familiarize yourself with the 2024 rates which are pictured below so you can accurately estimate your tax liability.

If you suspect you aren't withholding enough from your paycheck or you owed last year, the beginning of the year is a great time to change that with your employer. The IRS' Tax Withholding Estimator tool will estimate your current withholding and projected tax refund and can help you know what to adjust on your W-4 form. You can submit an updated W-4 form to your employer anytime of the year.

Another notable change is the introduction of new deductions and credits. These provisions aim to support specific industries, encourage investments, and provide relief to taxpayers in various ways. Understanding these deductions and credits can help you optimize your tax planning and potentially save you money.

For 2024, the standard tax deduction for single filers has been raised to $14,600, which is a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, which is up $1,500 from the previous year.

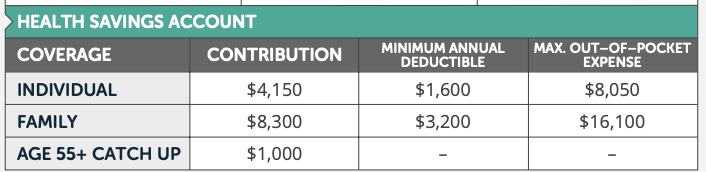

Additionally, the tax changes may include modifications to existing tax laws, such as changes to retirement account contributions, healthcare-related deductions, and education-related benefits. Health savings amounts are up about 7 percent from 2023. Individuals can contribute up to $4,150 to their HSA accounts for 2024, and families can contribute up to $8,300. Catch-up contribution limits for taxpayers 55 and older remain unchanged at $1,000.

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan is increased to $23,000, up from $22,500. The limit on annual contributions to an IRA increased to $7,000, up from $6,500. The IRA catch‑up contribution limit for individuals aged 50 and over remains $1,000 for 2024.

The catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan, remains $7,500 for 2024.

These increases are pictured below. Especially if you like to max out your retirement and health savings, make sure to double-check what's coming out of your paycheck with your employer.

Navigating the changes for small businesses

Individual taxpayers will be directly affected by the 2024 tax changes. The revised tax rates may result in either a higher or lower tax burden, depending on your income level and filing status. It is essential to review the new tax brackets and assess how they will affect your financial situation.

Moreover, the introduction of new deductions and credits can provide significant benefits to individuals. For example, there may be deductions available for certain healthcare expenses, education costs, or even energy-efficient home improvements. Taking advantage of these deductions can help lower your taxable income and reduce your overall tax liability.

However, it's important to note that not all changes may be favorable for individuals. Some deductions or credits may be phased out or subject to certain income limitations.

Understanding these limitations will help you plan your finances accordingly and avoid any unexpected surprises when filing your taxes.

Strategies to optimize your tax planning

Small business owners must also be aware of the tax changes that will come into effect in 2024. These changes may include alterations to corporate tax rates, modifications to business expense deductions, and updates to depreciation rules.

It is essential for small business owners to review their financial records and consult with a tax professional to determine how these changes will impact their bottom line. By understanding the new tax implications, business owners can make informed decisions regarding their operations, investments, and overall tax planning strategies.

Additionally, the 2024 tax changes may bring new opportunities for small businesses. For example, there may be tax incentives for hiring and training employees, investing in research and development, or expanding into certain geographic areas. Being aware of these incentives can help small business owners maximize their tax savings and stimulate growth.

Important deadlines and filing requirements

With the 2024 tax changes on the horizon, it's crucial to develop effective strategies to optimize your tax planning. Here are some key strategies to consider:

1. Stay organized: Keep track of your income, expenses, and financial transactions throughout the year. Maintaining accurate records will make it easier to identify deductions, credits, and potential areas for tax optimization.

2. Maximize retirement contributions: Take advantage of tax-advantaged retirement accounts, such as 401(k)s or IRAs. Contributing the maximum allowed amount can help lower your taxable income and potentially reduce your tax liability.

3. Explore tax-advantaged investments: Consider investing in tax-advantaged vehicles, such as municipal bonds or certain retirement plans, which may offer tax-free or tax-deferred growth.

4. Review your business structure: If you own a business, evaluate whether your current business structure is still the most tax-efficient option. Consulting with a tax professional can help you determine if a different structure, such as an S-corporation or LLC, would be more advantageous.

5. Take advantage of deductions and credits: Familiarize yourself with the new deductions and credits introduced in the 2024 tax changes. Identify those that apply to your situation and ensure you meet the eligibility criteria to maximize your tax savings.

Common misconceptions about the tax changes

As the 2024 tax changes come into effect, it's vital to be aware of the updated deadlines and filing requirements. Make sure you understand the due dates for filing your tax returns, submitting any necessary documentation, and paying any taxes owed.

Additionally, stay informed about any changes to tax filing methods or requirements, such as electronic filing or new forms. Being aware of these updates will help you avoid penalties and ensure a smooth tax filing process.

Resources for staying updated on the latest developments

With any significant tax changes, there are bound to be misconceptions or misunderstandings. It's essential to separate fact from fiction to make informed decisions about your tax planning. Here are some common misconceptions you may encounter:

1. Misconception: The tax changes will automatically result in higher taxes for everyone.

Fact: While some individuals or businesses may experience higher tax liabilities, others may see a decrease. The impact of the tax changes largely depends on individual circumstances, income levels, and various factors. It's important to assess your specific situation rather than making assumptions based on generalizations.

2. Misconception: The tax changes will simplify the tax code.

Fact: While tax changes may aim to simplify certain aspects of the tax code, they can also introduce new complexities. Understanding the updated provisions and their implications is crucial to ensure accurate tax planning and compliance.

3. Misconception: The tax changes are permanent.

Fact: Tax laws are subject to change over time. Although the 2024 tax changes may have a significant impact, it's important to stay vigilant and be prepared for potential future revisions.

Seeking professional help for tax planning

To stay informed about the latest developments regarding the 2024 tax changes, utilize reliable resources such as:

1. Government websites: The official websites of tax authorities provide up-to-date information, forms, and resources related to tax changes.

2. News publications: Stay tuned to reputable news sources that cover tax and financial matters. They often provide analysis, insights, and updates on tax changes.

3. Professional tax services: Consult with tax professionals or certified public accountants who specialize in tax planning. They can provide personalized guidance and advice based on your specific circumstances.

Conclusion: Embracing the changes and maximizing your financial benefits

Navigating the 2024 tax changes may seem overwhelming, especially if you have complex financial situations or own a business. In such cases, seeking professional help can provide valuable assistance in optimizing your tax planning.

Tax professionals have the knowledge and expertise to analyze your financial situation, identify potential tax savings opportunities, and ensure compliance with the latest tax laws.

Their guidance can help you make informed decisions and alleviate the stress of navigating the intricacies of the tax code on your own.

Important Disclosure

This information is not intended as tax or accounting advice. Please consult with a licensed tax professional before implementing any tax planning strategies.

.png)

Comments